Difference between revisions of "IRS and CRA - Automatic Verification"

(→Database Check Records on the Company Profile) |

|||

| Line 6: | Line 6: | ||

==Database Check Records on the Company Profile== | ==Database Check Records on the Company Profile== | ||

| + | When configured, this feature will display each check against the online database as a [[transaction]] on the Organization profile. Each type of check can be displayed as a different tab. | ||

| − | + | In the example below, checks against the IRS database are stored under a tab named "Tax Check":<br /> | |

[[Image:TransactionListOnOrgRecord.png|link=|500px]] | [[Image:TransactionListOnOrgRecord.png|link=|500px]] | ||

| + | |||

| + | Clicking the ''Open'' button will open the specific tax check transaction:<br /> | ||

[[Image:TransactionOnOrgRecord.png|link=|500px]] | [[Image:TransactionOnOrgRecord.png|link=|500px]] | ||

| + | |||

| + | From the specific tax check, another check against the online database (in this case, the IRS database) can be performed manually by clicking on the ''Search'' button:<br /> | ||

| + | [[Image:OpeningOrgsearchFromTransaction.png|link=|500px]] | ||

==Configuration== | ==Configuration== | ||

Revision as of 14:36, 22 November 2013

SmartSimple supports automatic verification of organizations with multiple databases such as IRS, CRA, OFAC, or UK Charities.

System Administrators can set up automatic monthly checks of organizations in a certain category or categories against these databases, and save the record of the check as a transaction on the company profile.

Database Check Records on the Company Profile

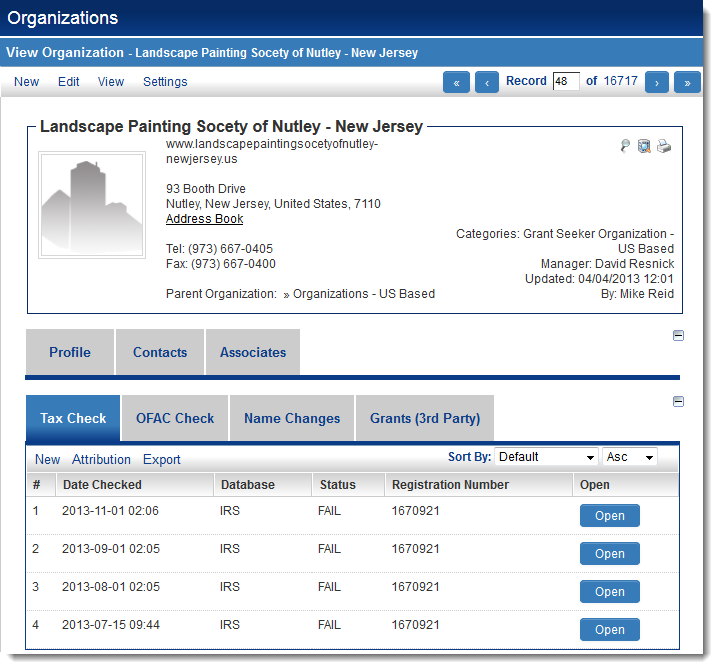

When configured, this feature will display each check against the online database as a transaction on the Organization profile. Each type of check can be displayed as a different tab.

In the example below, checks against the IRS database are stored under a tab named "Tax Check":

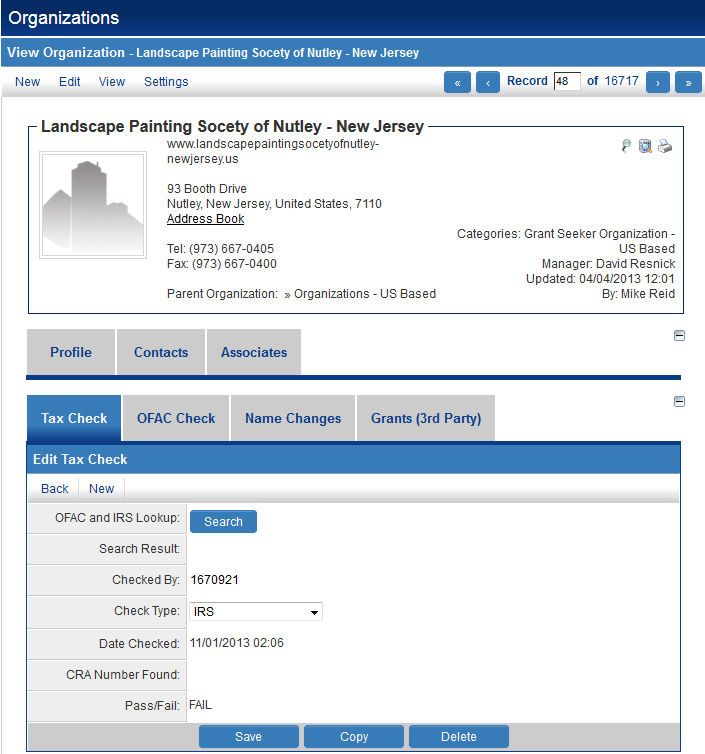

Clicking the Open button will open the specific tax check transaction:

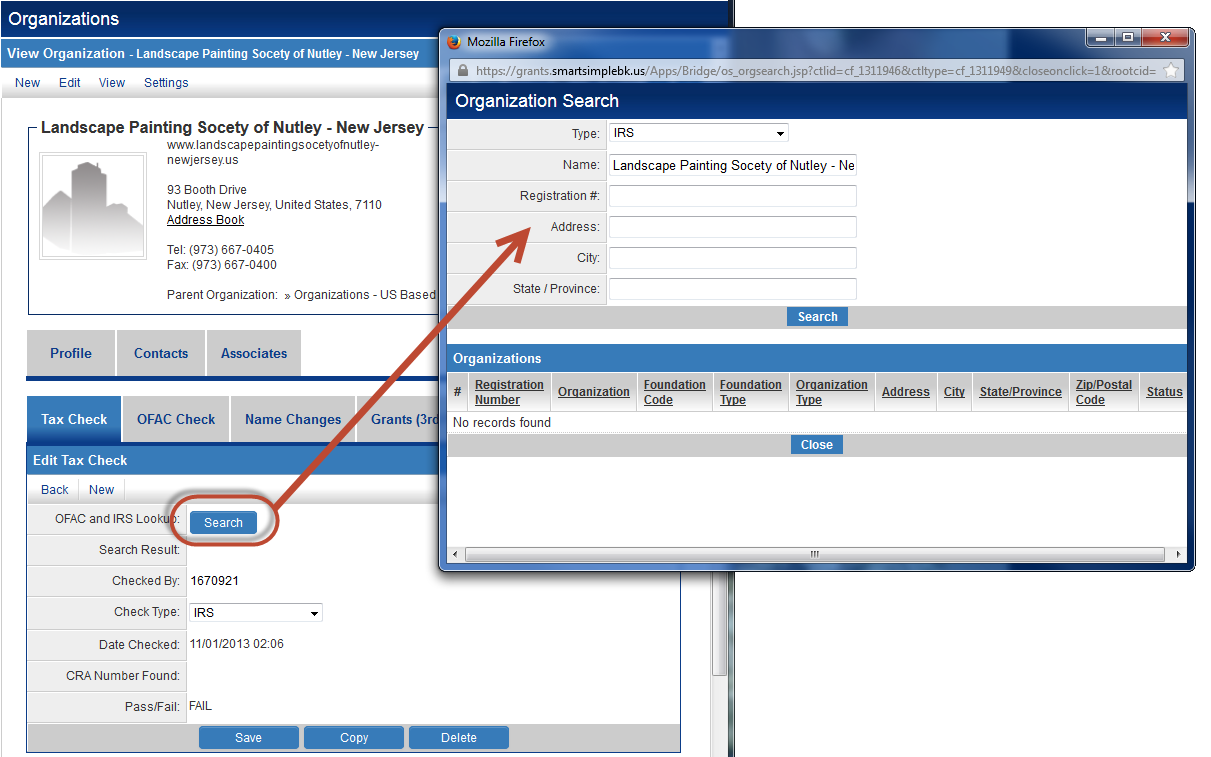

From the specific tax check, another check against the online database (in this case, the IRS database) can be performed manually by clicking on the Search button:

Configuration

Name:

Type:

Display Order:

Associated Roles:

Name:

Type:

Display Order:

Associated Roles:

Everyone Declined Registrant Former Employee Internal Staff New Registrant Org Contact AND Reviewer Organization Contact Organization Contact - TEST Reviewer Role with No Access System Administrator

Denied View Roles:

Declined Registrant Former Employee Internal Staff New Registrant Org Contact AND Reviewer Organization Contact Organization Contact - TEST Reviewer Role with No Access System Administrator

Transaction Type Linkage:

CRA Check - Automatic CRA Check - Manual

Use Publication Service: Use Third party Verification Service: Enable Record Lock: Transaction Formula: UTA Level 1 Term: UTA Level 2 Lookup: UTA Level 2 Lookup Source: Import XML Tag

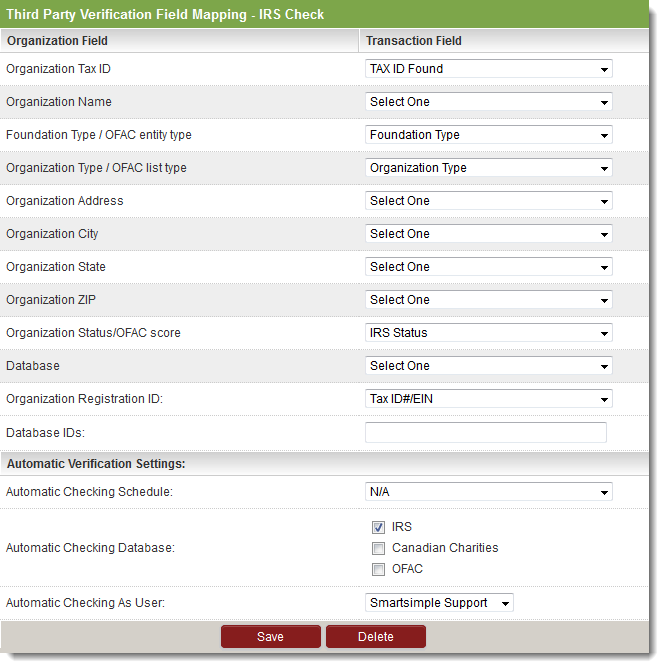

Organization Field Transaction Field

Organization Tax ID

Organization Name

Foundation Type / OFAC entity type

Organization Type / OFAC list type

Organization Address

Organization City

Organization State

Organization ZIP

Organization Status/OFAC score

Database

Organization Registration ID:

Database IDs:

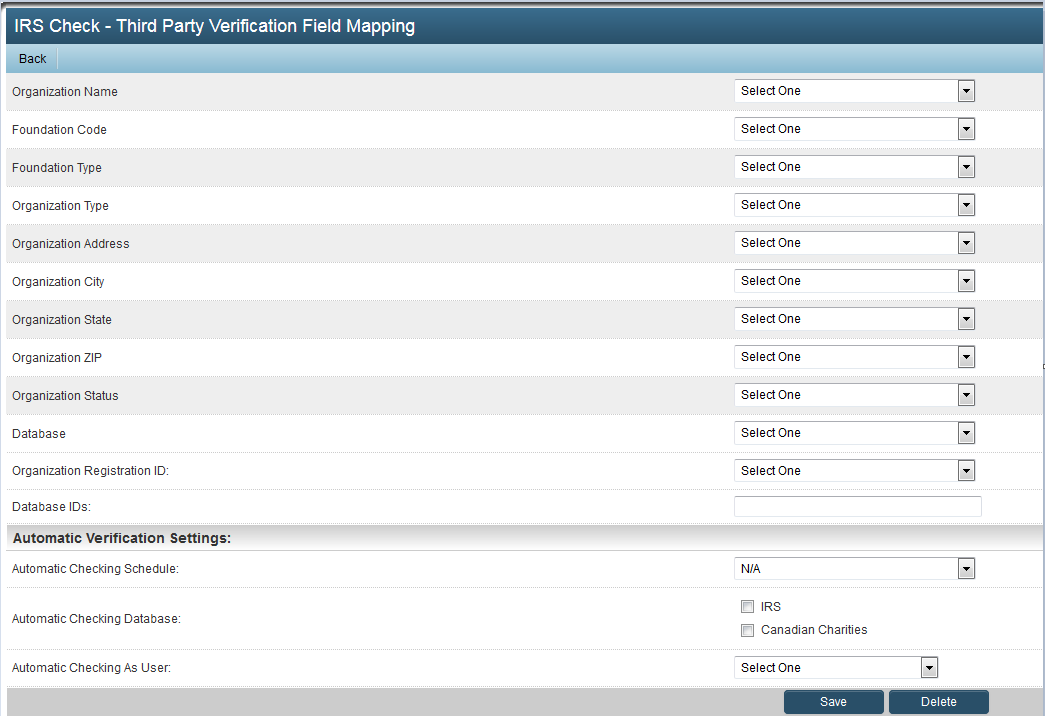

Automatic Verification Settings:

Automatic Checking Schedule: Can be set to N/A, Once a month, Once every two months or Once every three months

Automatic Checking Database:

IRS

Canadian Charities

OFAC

Automatic Checking As User: This is a drop down field providing a selection of internal users in your system.

Organization Field Transaction Field

Organization Tax ID

Organization Name

Foundation Type / OFAC entity type

Organization Type / OFAC list type

Organization Address

Organization City

Organization State

Organization ZIP

Organization Status/OFAC score

Database

Organization Registration ID:

Database IDs:

Automatic Verification Settings:

Automatic Checking Schedule: Can be set to N/A, Once a month, Once every two months or Once every three months

Automatic Checking Database:

IRS

Canadian Charities

OFAC

Automatic Checking As User: This is a drop down field providing a selection of internal users in your system.

See Also

- OFAC, IRS, CRA Checks

- IRS and CRA lookup (for further configuration instructions)