IRS and CRA - Automatic Verification

SmartSimple supports automatic verification of organizations with multiple databases such as IRS, CRA, OFAC, or UK Charities.

System Administrators can set up automatic monthly checks of organizations in a certain category against these databases, and save the record of the check as a transaction on the company profile.

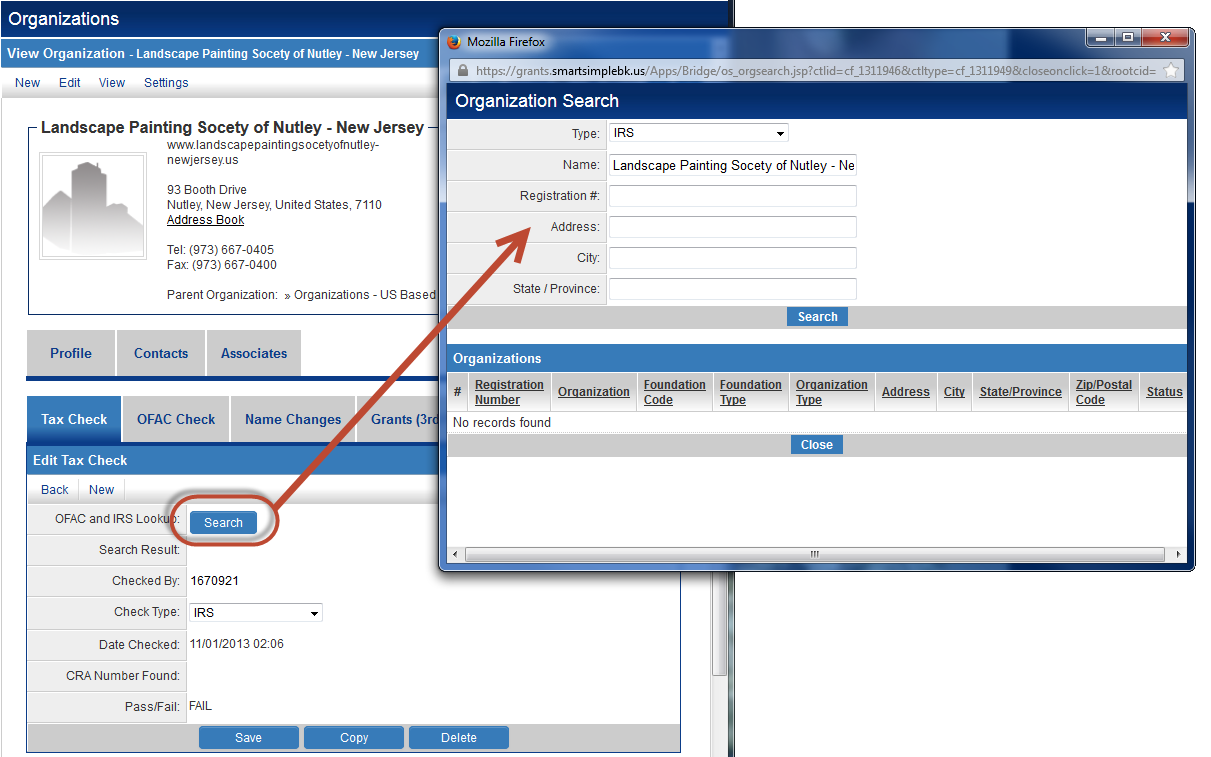

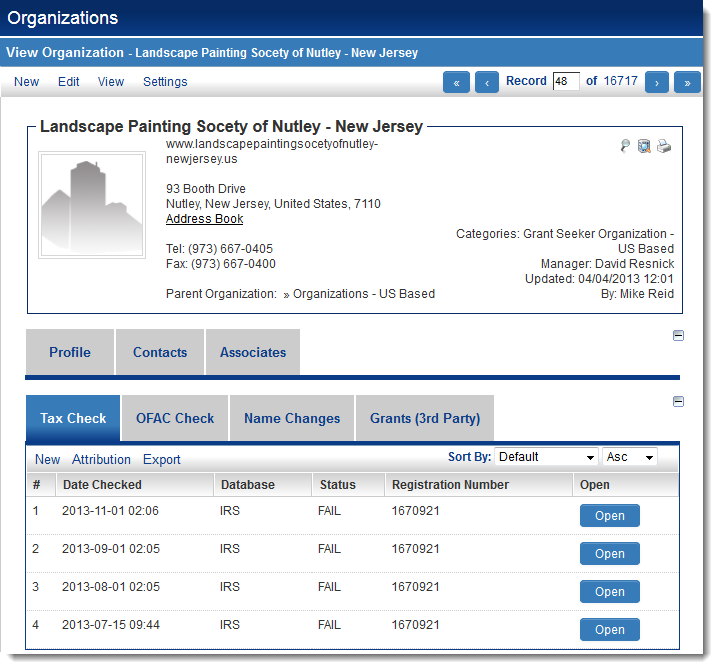

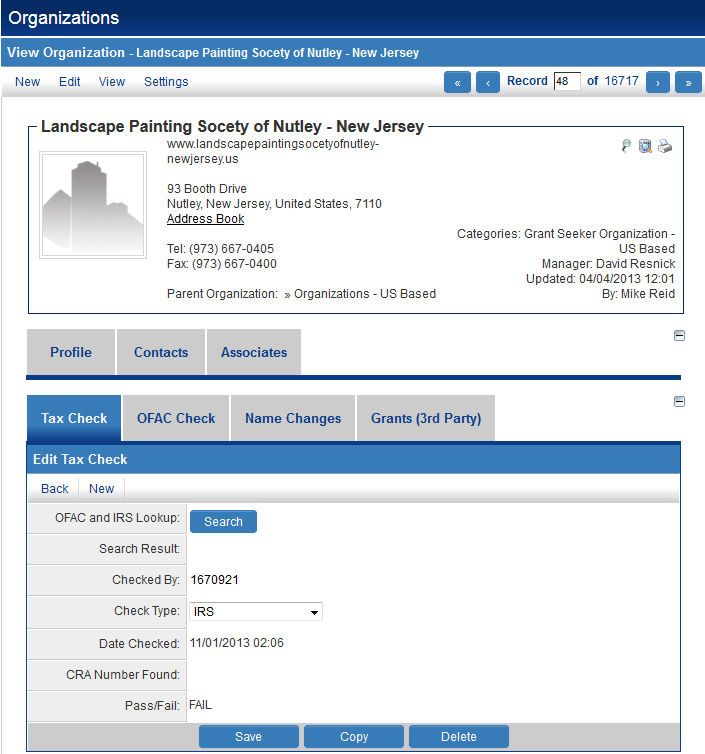

Database Check Records on the Company Profile

Configuration

Name:

Type:

Display Order:

Associated Roles:

Name:

Type:

Display Order:

Associated Roles:

Everyone Declined Registrant Former Employee Internal Staff New Registrant Org Contact AND Reviewer Organization Contact Organization Contact - TEST Reviewer Role with No Access System Administrator

Denied View Roles:

Declined Registrant Former Employee Internal Staff New Registrant Org Contact AND Reviewer Organization Contact Organization Contact - TEST Reviewer Role with No Access System Administrator

Transaction Type Linkage:

CRA Check - Automatic CRA Check - Manual

Use Publication Service: Use Third party Verification Service: Enable Record Lock: Transaction Formula: UTA Level 1 Term: UTA Level 2 Lookup: UTA Level 2 Lookup Source: Import XML Tag

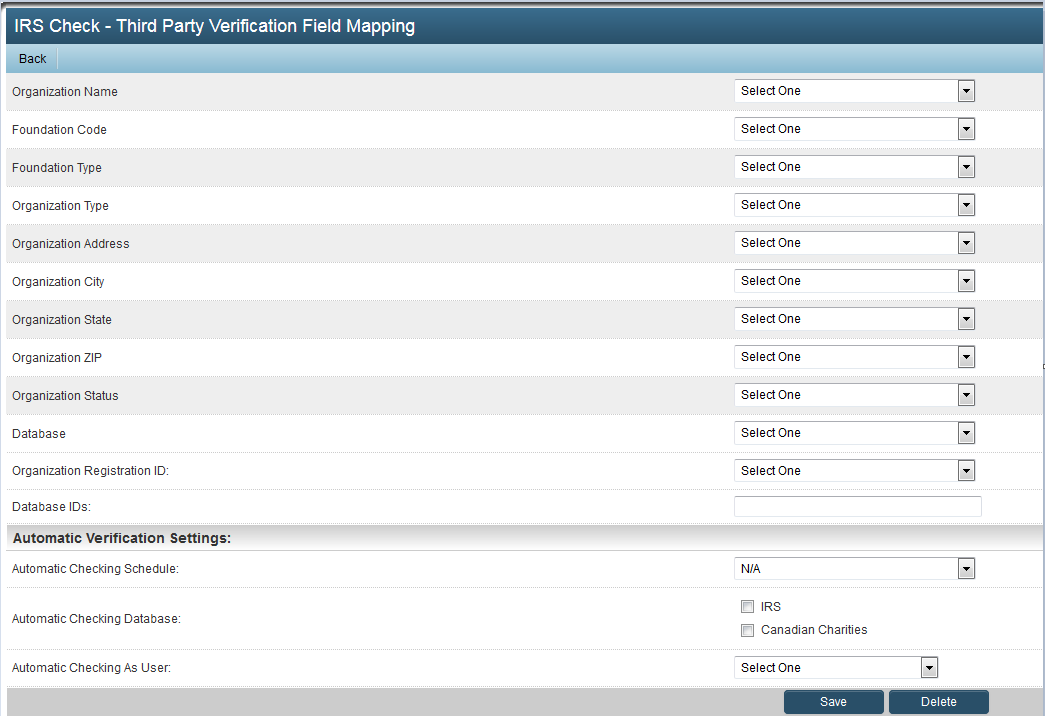

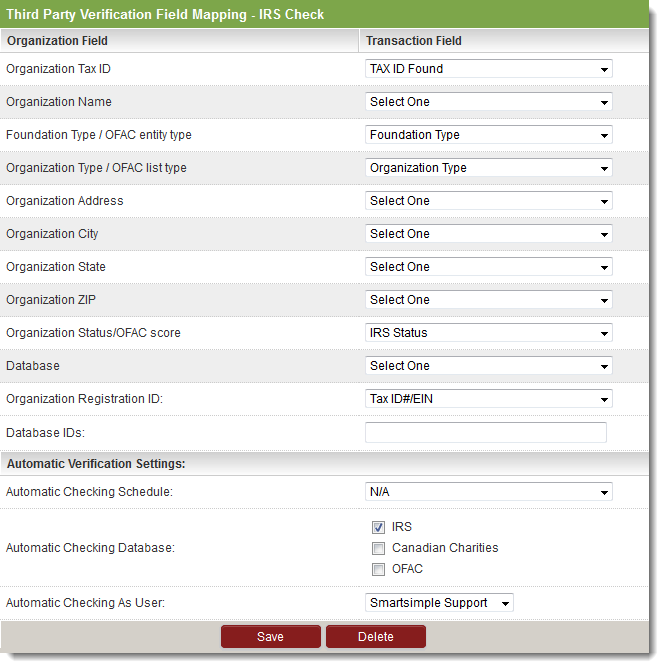

Organization Field Transaction Field

Organization Tax ID

Organization Name

Foundation Type / OFAC entity type

Organization Type / OFAC list type

Organization Address

Organization City

Organization State

Organization ZIP

Organization Status/OFAC score

Database

Organization Registration ID:

Database IDs:

Automatic Verification Settings:

Automatic Checking Schedule: Can be set to N/A, Once a month, Once every two months or Once every three months

Automatic Checking Database:

IRS

Canadian Charities

OFAC

Automatic Checking As User: This is a drop down field providing a selection of internal users in your system.

Organization Field Transaction Field

Organization Tax ID

Organization Name

Foundation Type / OFAC entity type

Organization Type / OFAC list type

Organization Address

Organization City

Organization State

Organization ZIP

Organization Status/OFAC score

Database

Organization Registration ID:

Database IDs:

Automatic Verification Settings:

Automatic Checking Schedule: Can be set to N/A, Once a month, Once every two months or Once every three months

Automatic Checking Database:

IRS

Canadian Charities

OFAC

Automatic Checking As User: This is a drop down field providing a selection of internal users in your system.

See Also

- OFAC, IRS, CRA Checks

- IRS and CRA lookup (for further configuration instructions)