Difference between revisions of "IRS and CRA - Automatic Verification"

(→Database Check Records on the Company Profile) |

|||

| Line 12: | Line 12: | ||

Clicking the ''Open'' button will open the specific tax check transaction:<br /> | Clicking the ''Open'' button will open the specific tax check transaction:<br /> | ||

| − | [[Image:TransactionOnOrgRecord.png|link=|500px]] | + | [[Image:TransactionOnOrgRecord.png|link=|500px]]<br /> |

| + | * The details of the check can be displayed, including the date the check was performed and a notification of whether the record was found on the IRS' database. | ||

| + | * In this case, a ''FAIL'' message was displayed, indicating that the organization was not found on the IRS' database. | ||

From the specific tax check, another check against the online database (in this case, the IRS database) can be performed manually by clicking on the ''Search'' button:<br /> | From the specific tax check, another check against the online database (in this case, the IRS database) can be performed manually by clicking on the ''Search'' button:<br /> | ||

Revision as of 13:39, 22 November 2013

SmartSimple supports automatic verification of organizations with multiple databases such as IRS, CRA, OFAC, or UK Charities.

System Administrators can set up automatic monthly checks of organizations in a certain category or categories against these databases, and save the record of the check as a transaction on the company profile.

Database Check Records on the Company Profile

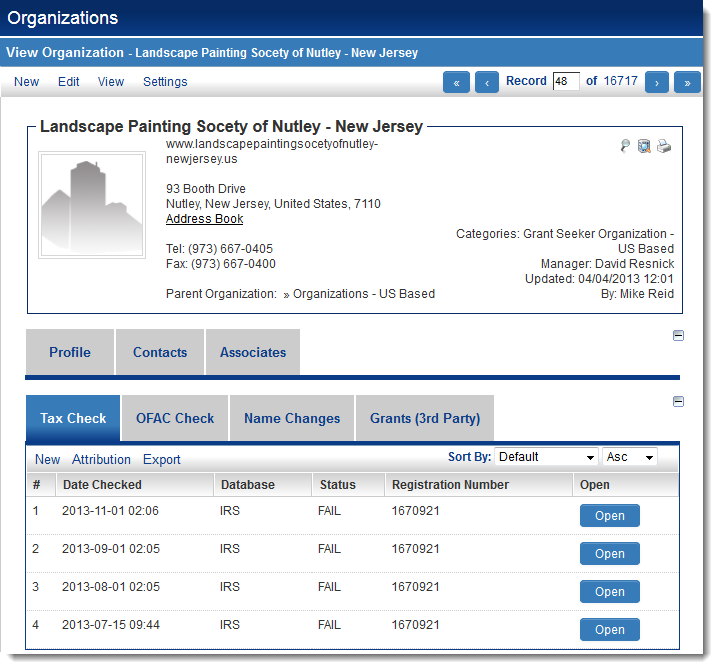

When configured, this feature will display each check against the online database as a transaction on the Organization profile. Each type of check can be displayed as a different tab.

In the example below, checks against the IRS database are stored under a tab named "Tax Check":

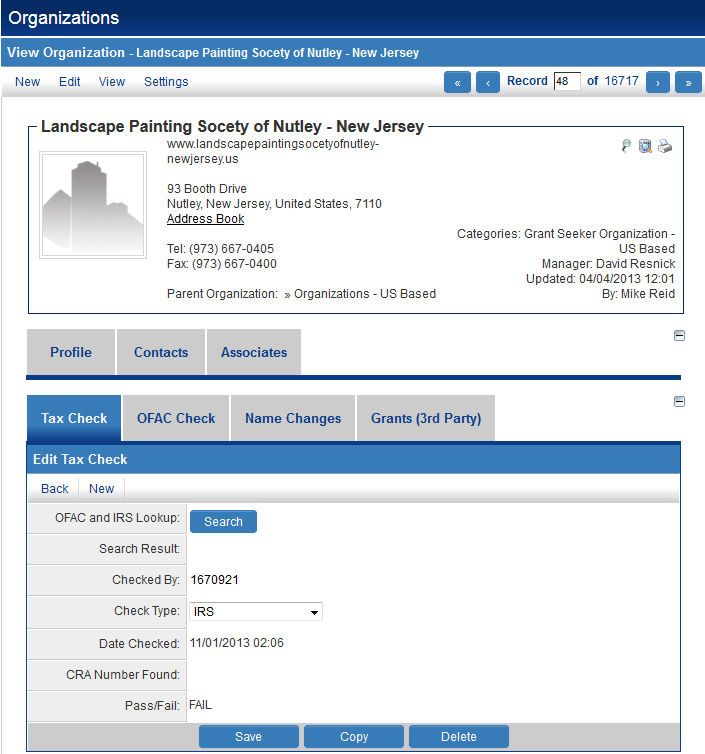

Clicking the Open button will open the specific tax check transaction:

- The details of the check can be displayed, including the date the check was performed and a notification of whether the record was found on the IRS' database.

- In this case, a FAIL message was displayed, indicating that the organization was not found on the IRS' database.

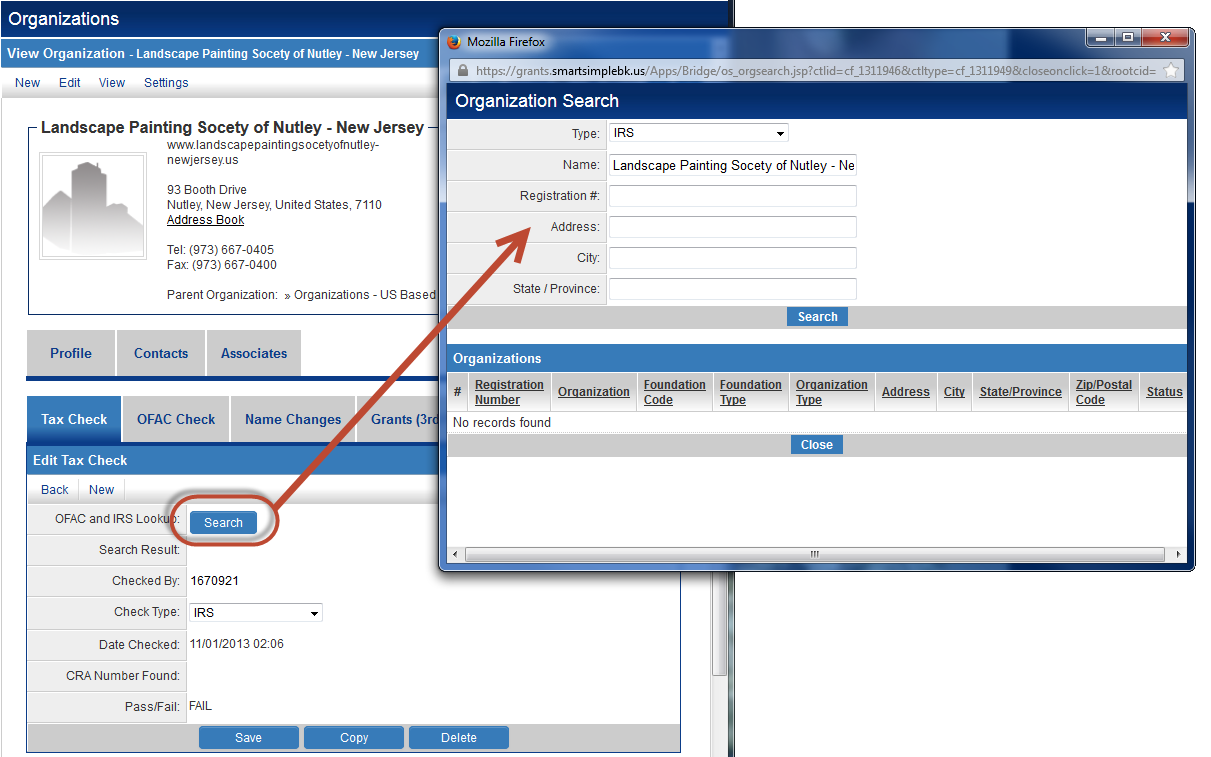

From the specific tax check, another check against the online database (in this case, the IRS database) can be performed manually by clicking on the Search button:

Configuration

Name:

Type:

Display Order:

Associated Roles:

Name:

Type:

Display Order:

Associated Roles:

Everyone Declined Registrant Former Employee Internal Staff New Registrant Org Contact AND Reviewer Organization Contact Organization Contact - TEST Reviewer Role with No Access System Administrator

Denied View Roles:

Declined Registrant Former Employee Internal Staff New Registrant Org Contact AND Reviewer Organization Contact Organization Contact - TEST Reviewer Role with No Access System Administrator

Transaction Type Linkage:

CRA Check - Automatic CRA Check - Manual

Use Publication Service: Use Third party Verification Service: Enable Record Lock: Transaction Formula: UTA Level 1 Term: UTA Level 2 Lookup: UTA Level 2 Lookup Source: Import XML Tag

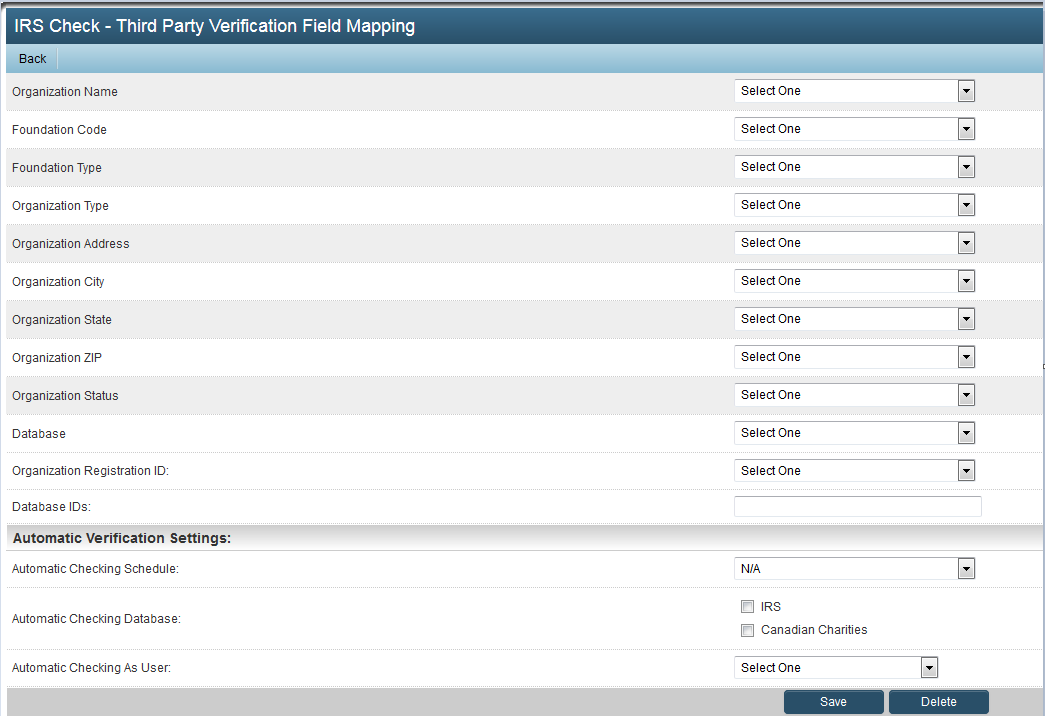

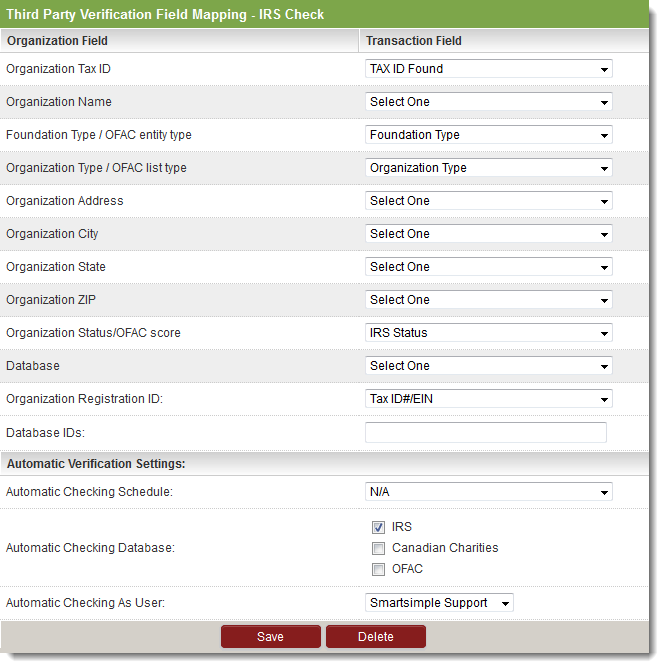

Organization Field Transaction Field

Organization Tax ID

Organization Name

Foundation Type / OFAC entity type

Organization Type / OFAC list type

Organization Address

Organization City

Organization State

Organization ZIP

Organization Status/OFAC score

Database

Organization Registration ID:

Database IDs:

Automatic Verification Settings:

Automatic Checking Schedule: Can be set to N/A, Once a month, Once every two months or Once every three months

Automatic Checking Database:

IRS

Canadian Charities

OFAC

Automatic Checking As User: This is a drop down field providing a selection of internal users in your system.

Organization Field Transaction Field

Organization Tax ID

Organization Name

Foundation Type / OFAC entity type

Organization Type / OFAC list type

Organization Address

Organization City

Organization State

Organization ZIP

Organization Status/OFAC score

Database

Organization Registration ID:

Database IDs:

Automatic Verification Settings:

Automatic Checking Schedule: Can be set to N/A, Once a month, Once every two months or Once every three months

Automatic Checking Database:

IRS

Canadian Charities

OFAC

Automatic Checking As User: This is a drop down field providing a selection of internal users in your system.

See Also

- OFAC, IRS, CRA Checks

- IRS and CRA lookup (for further configuration instructions)